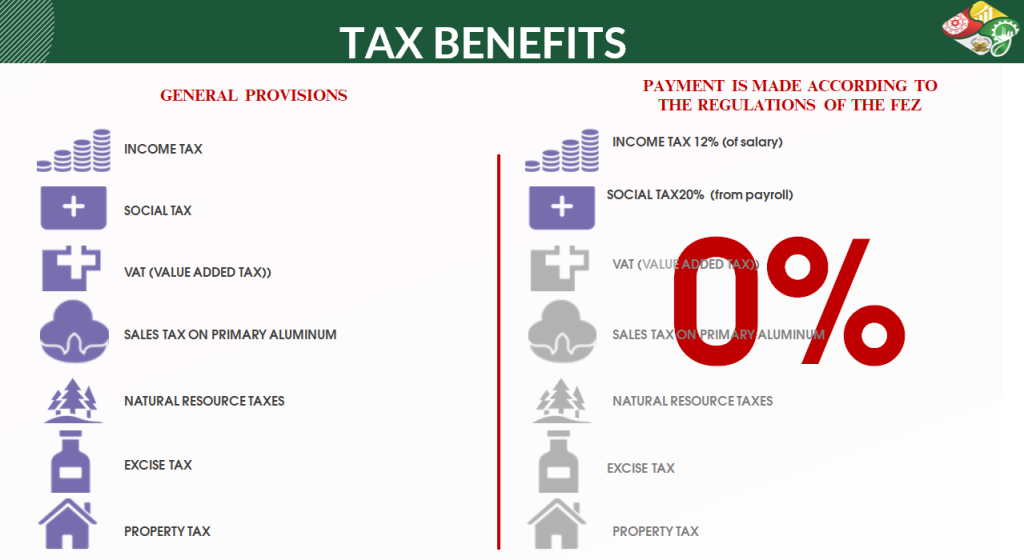

Besides favourable location, one of the attractive factors of the FEZ is the tax and customs privileges provided to FEZ subjects.

On FEZ ‘Kulob’ territories business activity of subjects regardless of ownership forms is exempted from payment of all types of taxes, which are specified in the Tax Code of the Republic of Tajikistan.

FEZ subjects perform the function of tax agents on collection and payment to the budget of social tax (20% of labour payment fund) and personal income tax (12%), i.e. FEZ subjects’ employees.